Global markets grappled with policy shifts, trade tensions and corporate deals, fueling notable volatility. This weekly briefing uncovers six key developments shaping investor strategies across global asset classes.

Equities Rally Near Record Highs Boosts Investor Sentiment

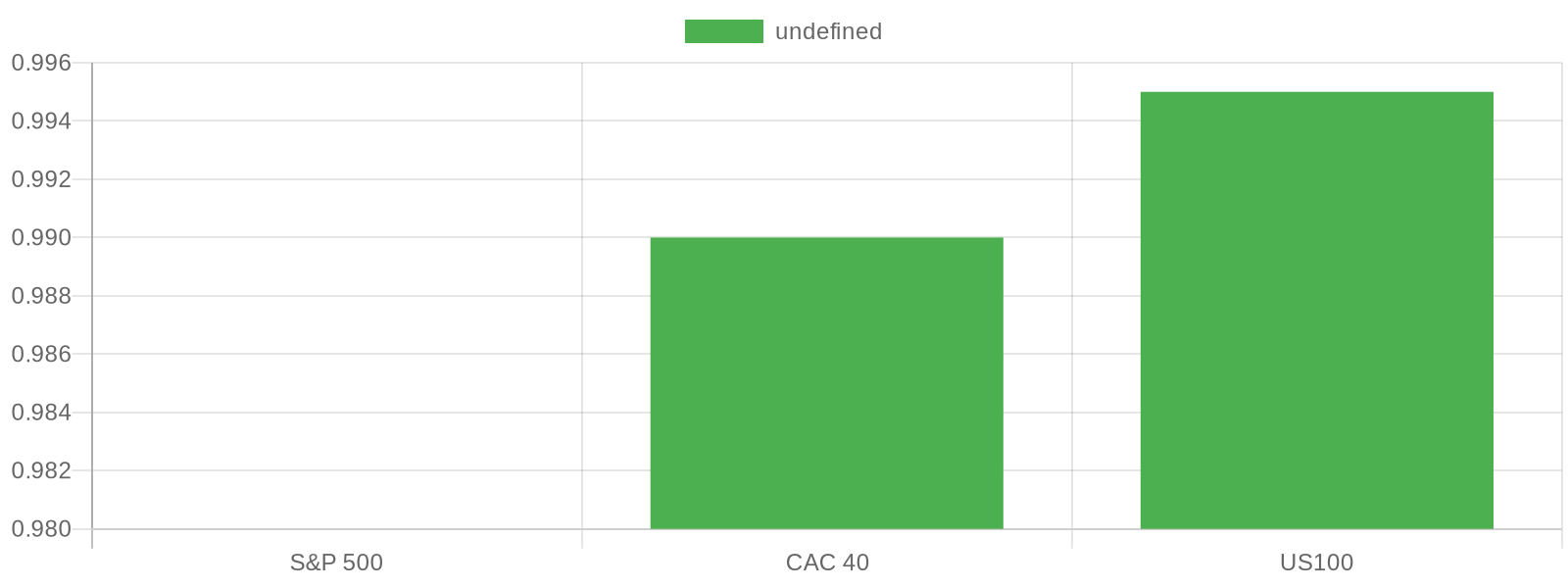

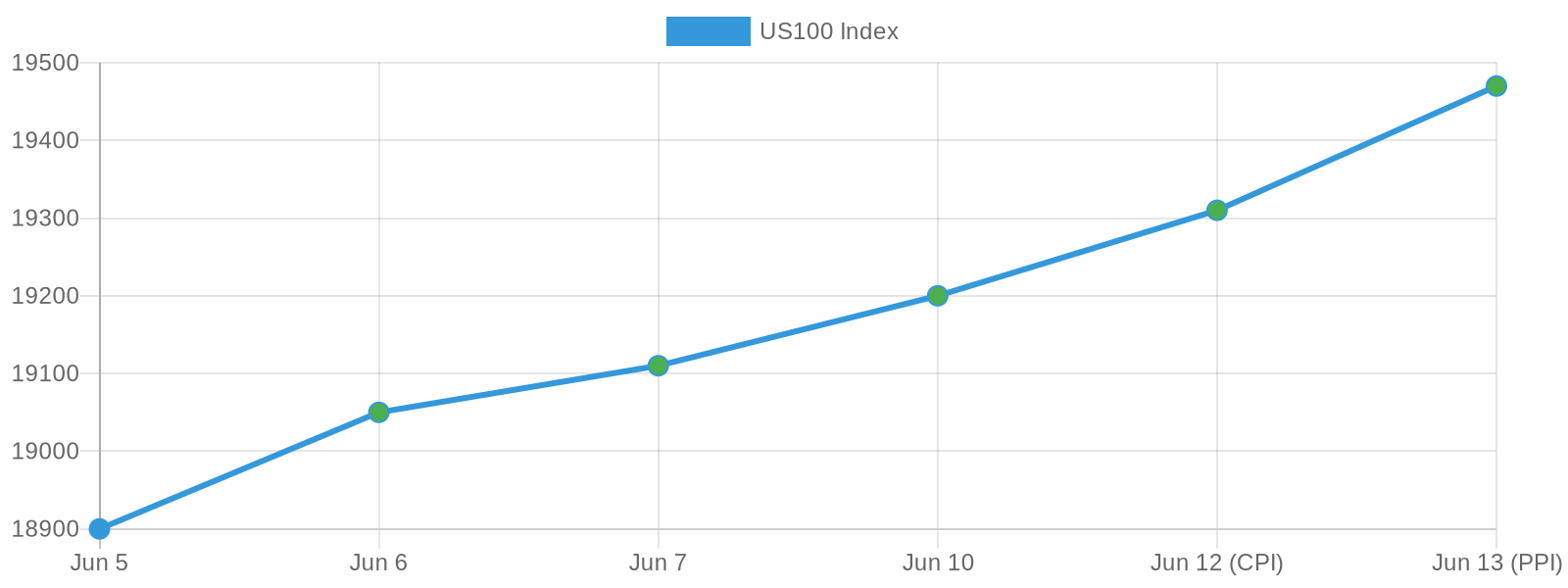

Global equity markets continued their upward momentum this week, with the S&P 500 trading just 2% below its February peak. In Europe, France’s CAC 40 climbed to 7,799.5, supported by resilient corporate earnings and an improved economic outlook. Tech-heavy indices like the US100 also hovered near historical highs, reflecting investor confidence in quality growth segments. While geopolitical tensions and inflation risks remain, the broad-based rally signals sustained risk appetite. Investors may consider recalibrating exposure toward defensive sectors and high-quality names with strong balance sheets amid the evolving macro environment.

RBI’s Steep Rate Cuts Power Indian Markets

India’s central bank implemented aggressive monetary easing on June 6, cutting the repo rate by 50 basis points to 5.50% and reducing the cash reserve ratio (CRR) by 100 basis points. These moves injected liquidity amounting to ₹2.5 trillion into the financial system. Indian equity markets responded sharply: the Sensex surged 746.95 points to close at 82,188.99 and the Nifty topped the 25,000 level for the first time, closing at 25,003.05. Banking, real estate, and auto sectors led the rally, driven by expectations of increased credit growth and reduced borrowing costs. Yield-sensitive portfolios and real asset strategies stand to gain in this lower-rate environment.

ECB Lowers Rates and Signals Summer Pause

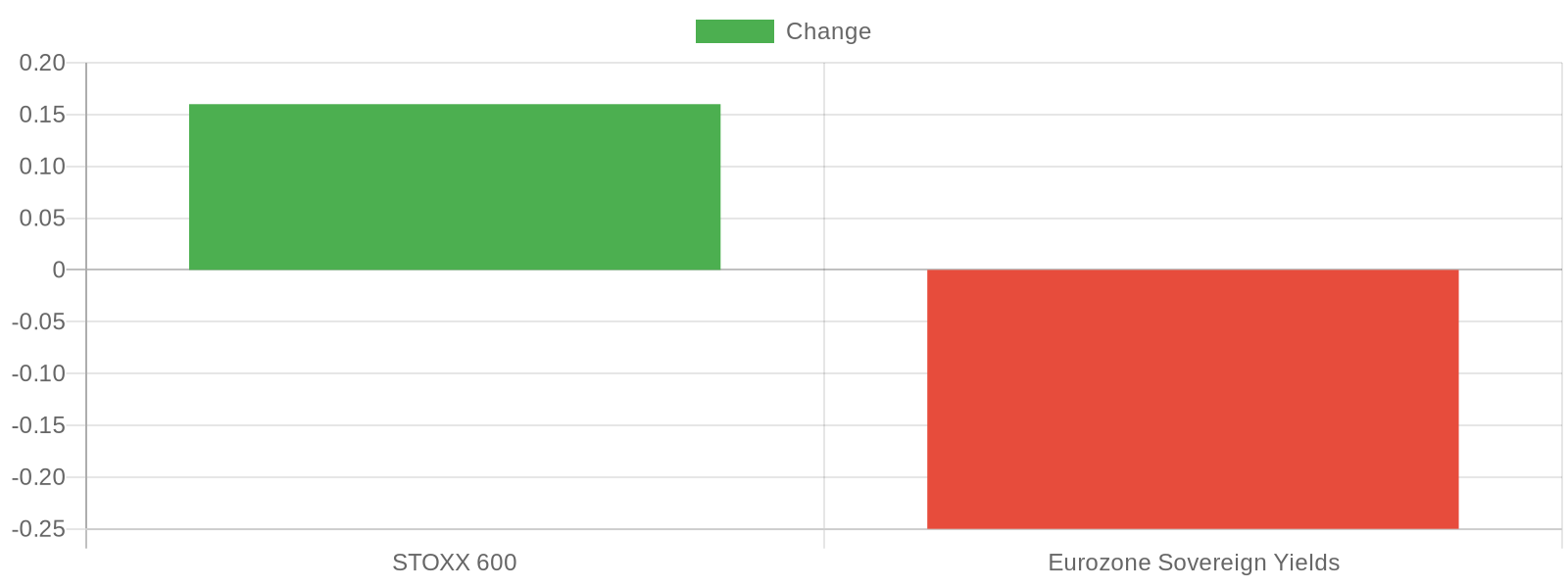

The European Central Bank reduced its benchmark interest rate by 25 basis points on June 6, marking its first rate cut since 2019. ECB President Christine Lagarde emphasized that future decisions would be data-dependent, signaling a likely pause over the summer. The move comes as eurozone inflation moderates toward the 2% target. In response, sovereign bond yields retreated across the bloc and the STOXX 600 gained 0.16%, reflecting cautious investor optimism. Wealth managers may look to diversify currency exposures and consider inflation-linked securities, particularly as global rate paths begin to diverge.

US-China Trade Talks Center on High-Tech Export Restrictions

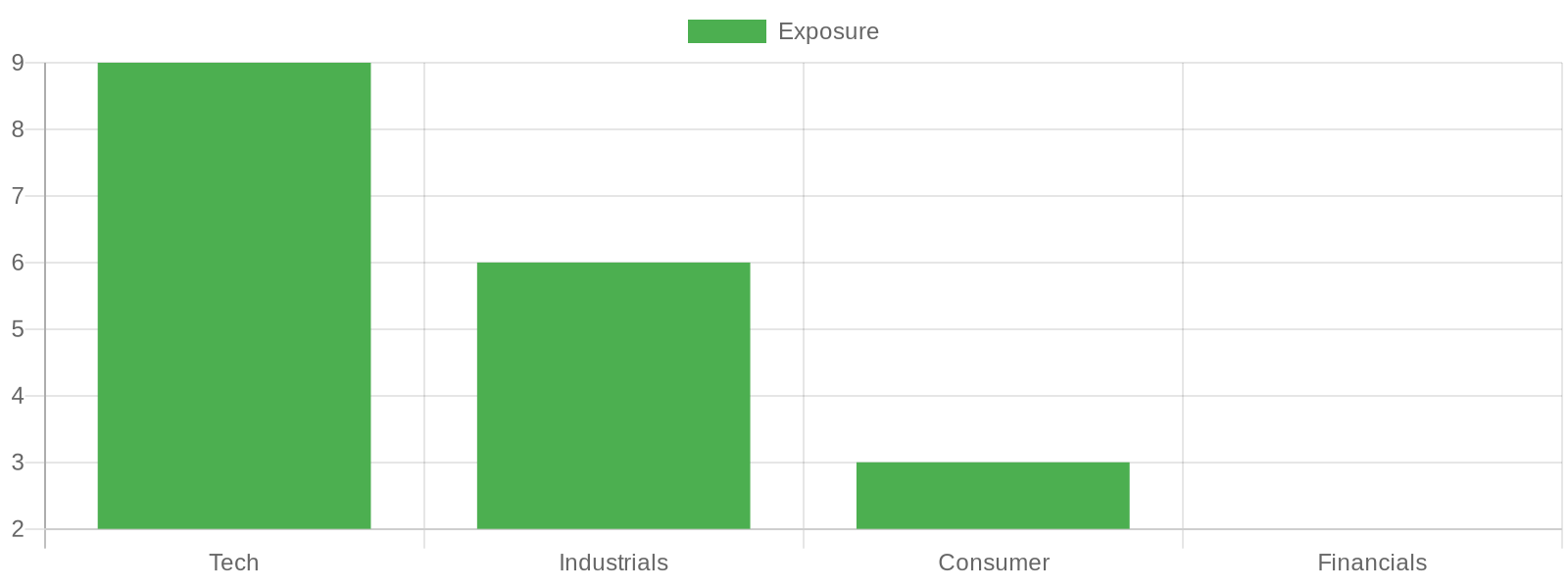

Senior delegates from the United States and China convened in London on June 9 to address deep-rooted tensions surrounding export controls and technology transfers. The discussions focused heavily on restrictions targeting semiconductors and other high-tech components, underlining ongoing strategic rivalry in defense and AI capabilities. Market participants remain cautious, as outcomes from these dialogues could significantly impact global supply chains. Equities in tech and industrial sectors remain particularly exposed to policy shifts, reinforcing the importance of diversified geopolitical risk management within portfolios.

Qualcomm’s $2.4 Billion Acquisition of Alphawave IP Enhances Semiconductor Play

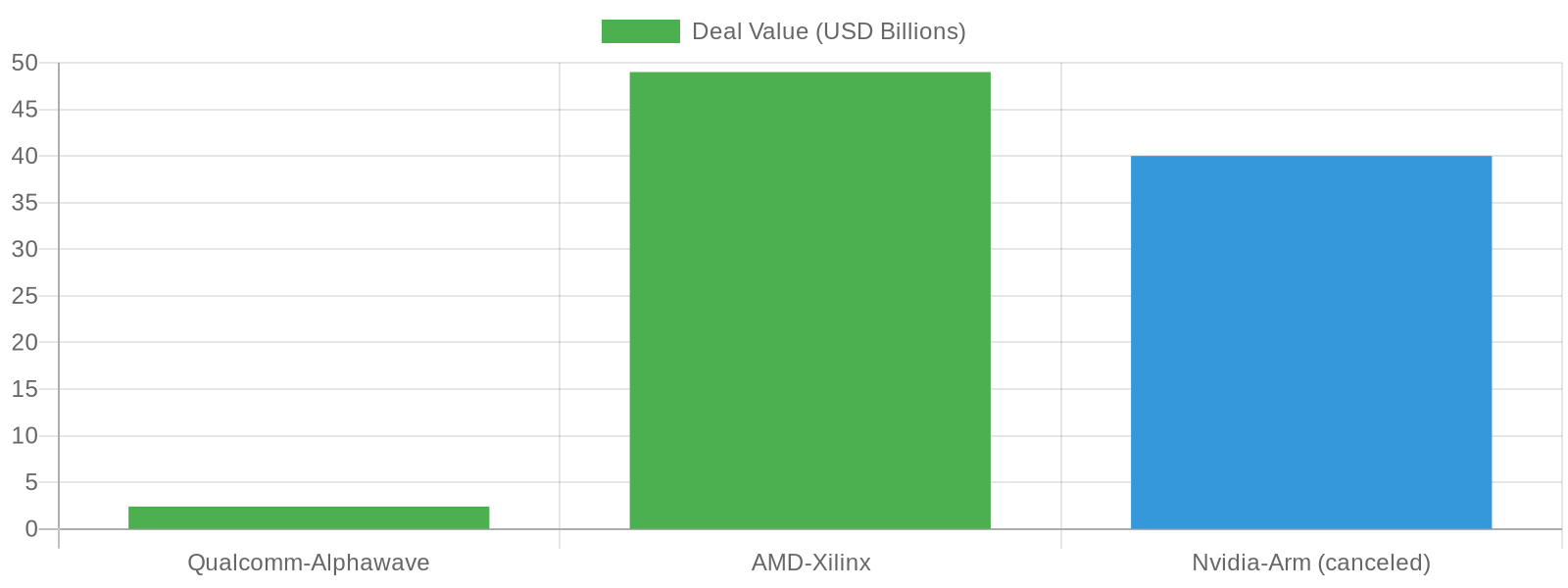

On June 7, US-based Qualcomm announced its agreement to acquire UK semiconductor design firm Alphawave IP in a $2.4 billion all-cash transaction. The deal strengthens Qualcomm’s position in the high-speed connectivity segment, crucial for next-generation infrastructure, including 5G and AI. Following months of strategic negotiations, the acquisition marks continued consolidation within the global chip industry. Investors may consider increased allocation to semiconductor leaders and critical component suppliers amid persistent demand for data-centric solutions.

Upcoming US Inflation Data to Influence Fed Policy and FX Markets

Markets are positioning ahead of key US inflation releases: the Consumer Price Index (CPI) on Wednesday and the Producer Price Index (PPI) on Thursday. These reports will be pivotal in shaping expectations for the Federal Reserve’s next policy move and in guiding currency markets, particularly the EUR/USD exchange rate. Elevated volatility is anticipated across FX and rates markets, with the tech-heavy US100 index trading near record highs and vulnerable to swings on inflation surprises. Investors may reassess portfolio hedges through Treasury Inflation-Protected Securities (TIPS) and diversified commodity exposures.

Markets moved higher this week amid global rate cuts, resilient earnings, and strategic deal-making, reinforcing investor appetite for risk-adjusted growth. Looking ahead, evolving monetary signals and fresh macro data—from Fed minutes to China’s GDP—will shape asset flows and tactical positioning.