This week, global markets navigated heightened geopolitical tensions, shifting monetary policy cues, and mixed growth signals. Our weekly roundup examines equity swings, debt stress, and hotspot developments across global and Indian markets.

Global Markets Play a Divergent Tune, Not a Funeral Dirge

Forget the talk of a synchronized global market collapse last week. The real story is far more nuanced and intriguing.

While a trio of formidable challenges – a hawkish U.S. Federal Reserve, souring global growth forecasts, and escalating geopolitical friction – cast a long shadow, the world’s equity markets refused to move in lockstep. Instead of a widespread downturn, the week ending June 20, 2025, delivered a fragmented picture of regional divergence and cautious consolidation.

While U.S. indices treaded water, with the S&P 500 seeing only a minor dip, European bourses painted a surprisingly resilient picture. Germany’s DAX, for instance, defied the gloomy narrative with a solid 1.3% gain. This wasn’t a story of a global fall, but rather a complex market grappling with a “policy trilemma” – a central bank battling inflation, persistent geopolitical threats, and a weakening economic outlook, leaving investors in a state of watchful waiting. The much-hyped market stumble was, in reality, a hesitant shuffle on a very uneven dance floor.

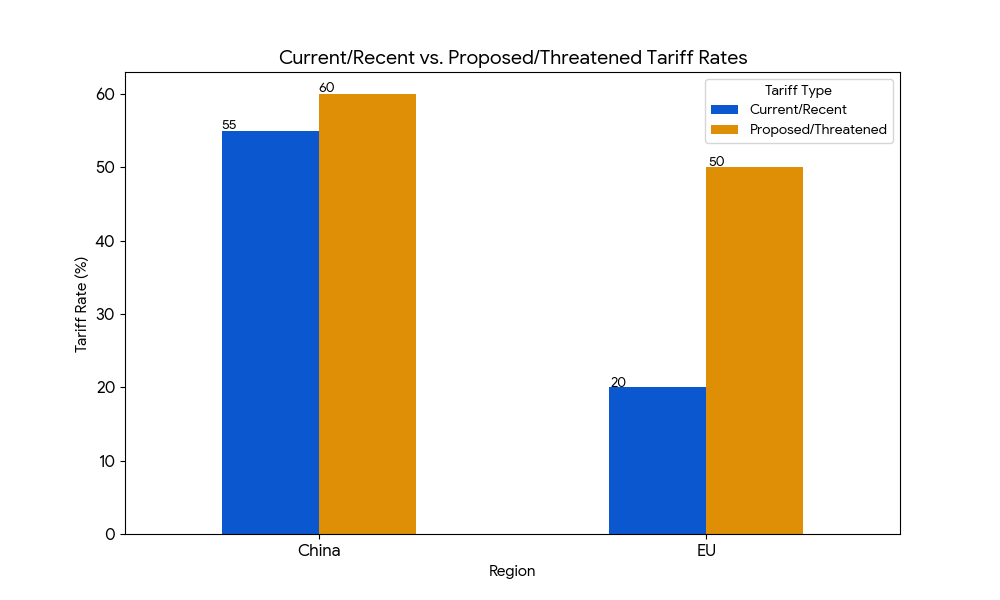

Escalating U.S. Trade Frictions Reignite Market Anxiety as Tariff Risks Resurface

Trade policy ambiguity returned to center stage this week as former President Donald Trump raised the prospect of revisiting steep tariffs, threatening levies up to 50% on European imports. Negotiations with Brussels resumed following legal appeals related to suspended duties, while U.S.-China tensions persist despite a recent détente. The geopolitical stance is fueling unease across the global manufacturing, automotive, and semiconductor sectors, which are already strained by complex supply chain dynamics. For institutional investors, the heightened unpredictability reinforces hedging behavior and raises caution around corporate forward guidance in trade-exposed industries.

Indian Benchmarks Post Strong Weekly Gains; IT and Financials Lead, Broader Market Lags

Indian equity benchmarks registered a strong performance in the week ending June 21, 2025. The BSE Sensex surged 1,289.57 points (+1.58%) to close at 82,408.17, while the Nifty 50 climbed 393.8 points (+1.59%) to settle at 25,112.40.

The rally was primarily driven by gains in IT, banking, auto, and realty stocks. However, the energy (Oil & Gas) and FMCG sectors bucked the trend and ended the week with losses. The market demonstrated resilience amid heightened geopolitical tensions in the Middle East, which led to volatility in crude oil prices. Investor sentiment was bolstered by robust inflows from both Foreign Portfolio Investors (FPIs) and Domestic Institutional Investors (DIIs).

In a sign of cautious sentiment and selective buying, the broader market did not participate in the rally. The BSE Mid-Cap index fell 0.44% and the BSE Small-Cap index declined 1.85%, indicating significant underperformance compared to the large-cap indices.

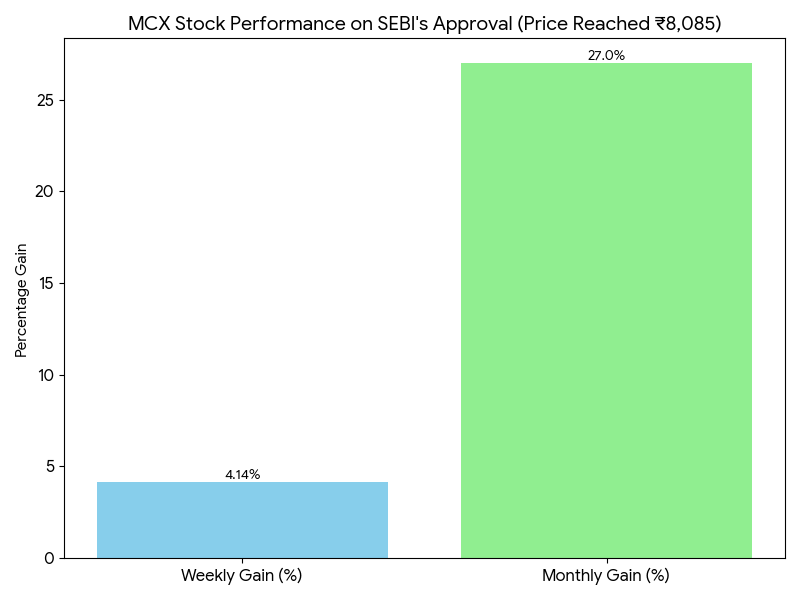

MCX Shares Surge as SEBI Approves Launch of Electricity Derivatives

Multi Commodity Exchange (MCX) stock surged recently, with a weekly gain of approximately 4.14%, bringing its price to ₹8,085 and extending its monthly gain to over 27%. The rally followed the Securities and Exchange Board of India’s (SEBI) approval for the exchange to introduce electricity futures and derivatives contracts.

Analysts have a positive outlook, anticipating that the new product class will be a key driver of growth for MCX’s transaction revenues as institutional and corporate hedging demand increases. The exchange is expected to benefit from broader participation by power sector stakeholders, including generators and distribution companies, who seek to manage price volatility. This move aligns with India’s strategic efforts to deepen its commodity markets and enhance risk management tools in the energy sector.

Markets faced a complex mix of geopolitical strain, credit pressures, and cautious monetary shifts, resulting in uneven asset performance and fragile investor sentiment. Looking ahead, global risk appetite will hinge on upcoming central bank signals and evolving trade policy developments.