Global markets navigated monetary, economic and geopolitical shifts between May 29 and June 4, 2025. This article spotlights six pivotal market and policy developments that investors must monitor.

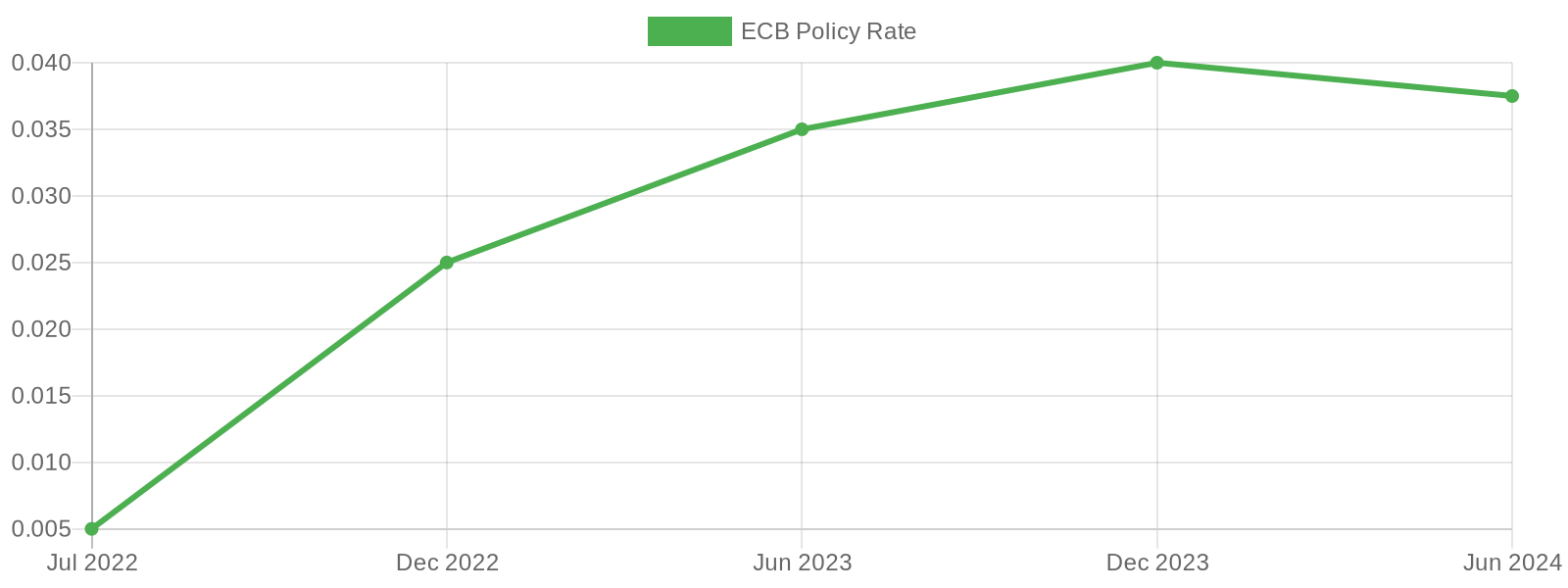

ECB Cuts Key Interest Rates by 25 Basis Points to Support Eurozone Recovery

The European Central Bank reduced its three key interest rates by 25 basis points on June 5, marking its first rate cut since the post-pandemic tightening phase began. This decision, prompted by a sustained decline in inflation to around 2%, is expected to support credit conditions and stimulate activity across the bond market and export-oriented industries.

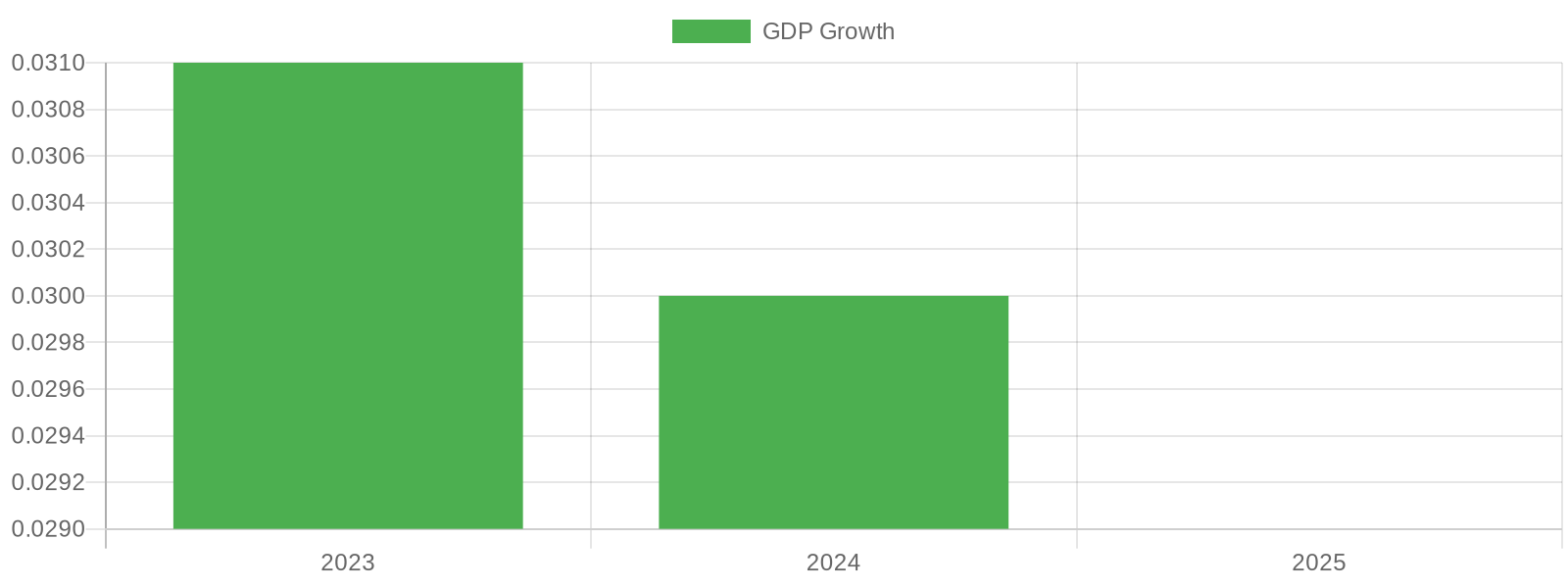

OECD Lowers Global Growth Forecast for 2025 to 2.9% amid Trade Frictions

The OECD revised its global GDP growth projection downward to 2.9% for 2025 in a report released on June 3, citing increased risks from US-China trade tensions and tighter financial conditions. This downgrade could weigh on commodity demand and complicate recovery prospects for emerging markets reliant on trade and stable global supply chains.

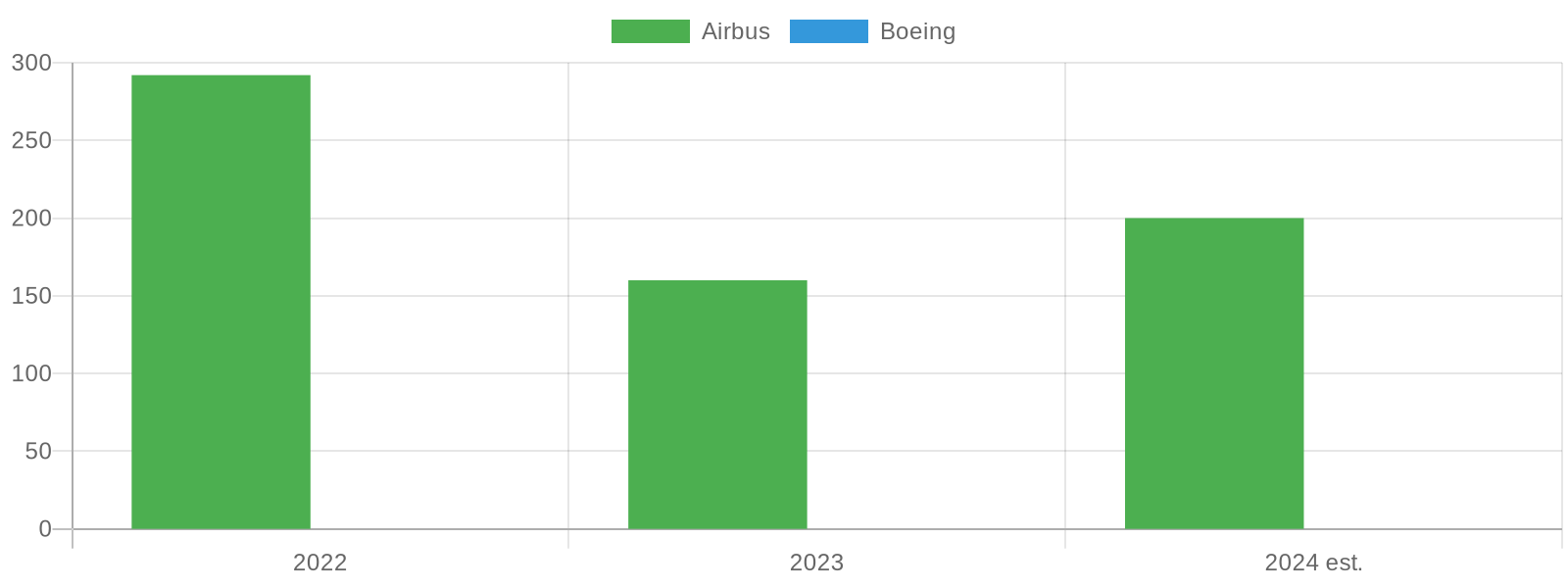

{“title”:”Airbus Outpaces Boeing in Chinese Orders”,”alt”:”Bar chart comparing Chinese aircraft orders for Airbus and Boeing”,”description”:”Displays Airbus’s increasing orders in China versus zero for Boeing, highlighting market share dynamics in the aviation sector.”,”filename”:”4729AB-china-aircraft-orders”}

Sensex Rallies 775 Points as RBI Cuts Key Policy Rate

The Reserve Bank of India lowered its repo rate on May 31, fueling strong investor sentiment and lifting the Sensex by 775 points to close at 81,775—a 0.96% gain. Sectors like pharmaceuticals, energy, and banking saw notable advances as traders anticipated improved liquidity and broader credit growth ahead of the monsoon season.

German Industrial Output Boosts Q2 GDP Despite Trade Headwinds

Germany’s economy showed an unexpected rebound in early Q2 2025, driven by a surge in industrial production aimed at meeting U.S. demand ahead of anticipated tariffs. The uptick benefits machinery and automotive exporters in the short term, although broader uncertainties face the Eurozone amid escalating trade frictions and diverging fiscal policies.

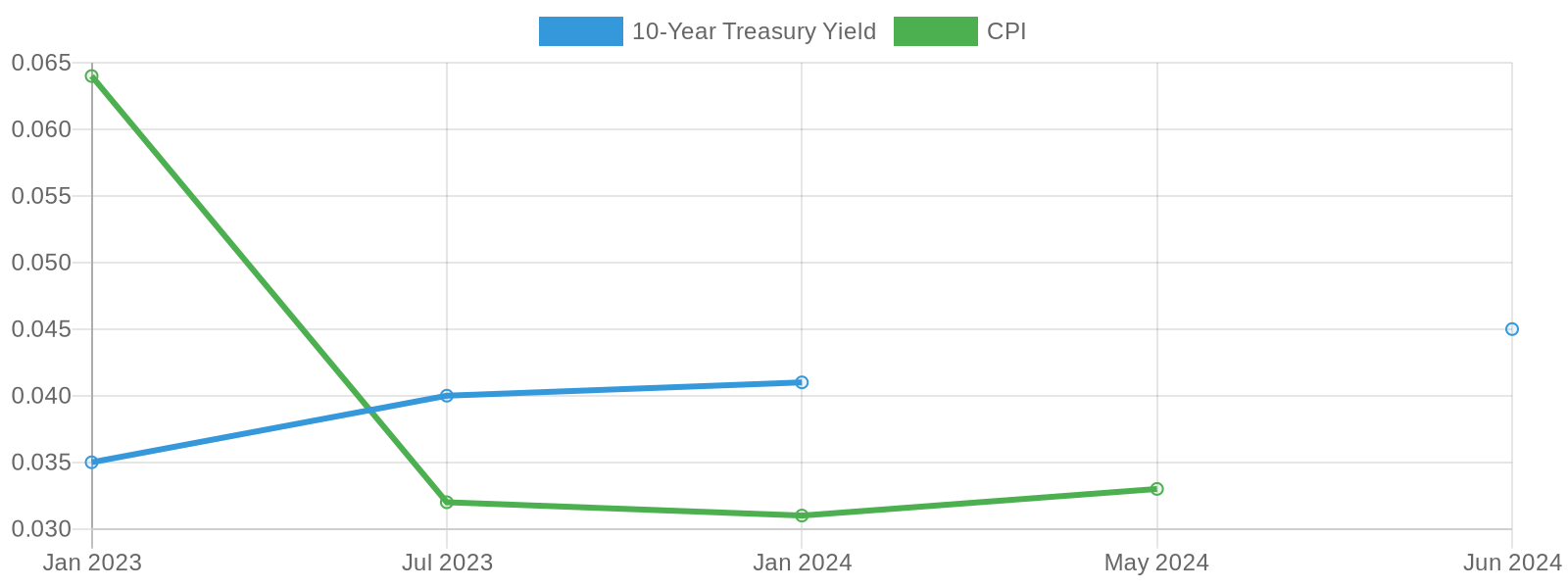

{“title”:”Treasury Yields vs Inflation Trends”,”alt”:”Line chart comparing U.S. 10-year Treasury yields and CPI inflation rates”,”description”:”Displays the relationship between bond yields and inflation, highlighting market expectations and economic conditions since January 2023.”,”filename”:”4729TY-yield-inflation”}

Markets reflected a delicate balance of monetary easing and geopolitical risk, as central banks responded to inflation trends while trade tensions reshaped global capital flows. Investors should stay attuned to upcoming policy signals and tariff developments that may recalibrate asset performance across regions and sectors.